This is according to Frank Lenisa, director at Compuscan credit bureau. He was commenting on Compuscan's latest information on consumers' credit behaviour in Q4 2014 which forms part of a detailed synopsis submitted to the National Credit Regulator (NCR).

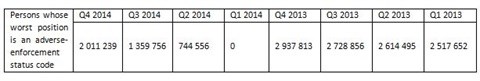

Lenisa says the increase is indicative of consumers not managing their expenditure wisely and struggling to stay on top of the escalating cost of living. Prior to the removal of adverse information, as at the end of Q1 2014, there were approximately three million consumers whose worst position was an adverse-enforcement status code.

This includes accounts that have been enforced as handed over, assets repossessed, account written off or facilities/credit card revoked. In less than a year, the number of consumers whose worst position was this status on an account increased from 0 at the end of Q1 2014, when the removal of adverse information took effect, to 2,011,239 as at the end of Q4 2014.

This means that a large percentage of individuals who had adverse listings which were removed by the regulations, have an adverse again and points to the need to improve repayment behaviour rather than removing credit information.

See table below for further details:

Note:

At the end of Q3 2014 there were 2,015,276 accounts listed as handed over, assets repossessed, account written off or facilities/credit card revoked. There are now 3,139,687 such accounts, which means that there was a 56% increase in adverse account listings in one quarter.

According to Compuscan's data, the number of consumers that have a judgment on their report as the worst of their negative information is 1,075,143, while the number of consumers that have an admin order as the worst of their negative information is 73,197.

"Although a fair amount of the data points to the fact that consumers are not carefully managing their credit obligations, it has also revealed positive trends in consumers' credit behaviour. Of all accounts in retention on the bureau, 76,59% were listed as zero months in arrears or closed. In other words, this reflects the percentage of current accounts. Despite the fact that we saw accounts with adverse enforcement codes increase by 56% from quarter to quarter, this classification only makes up 4,51% of all updated accounts in retention on the bureau," Lenisa explains.

Furthermore, on a positive note, the data shows an 81% increase in accounts that have a paid-up default status in Q4 2014 compared to the previous quarter, indicating that some consumers are making efforts to better manage their debt.

Yet another interesting trend that has been revealed is an increase in revolving loans. From Q3 2014 to Q4 2014, there was a 22% increase in this type of loan. More significantly, there was an increase of 134% in revolving loans specifically between R8,001 and R15,000 and a 77% increase thereof between R15,001 and R25,000.