Top stories

Marketing & MediaWarner Bros. was “nice to have” but not at any price, says Netflix

Karabo Ledwaba 1 day

More news

Logistics & Transport

Maersk reroutes sailings around Africa amid Red Sea constraints

Based on data from over 200 independent hotels, bed and breakfasts, lodges, and guesthouses in South Africa, the report unpacks performance across several key areas, including occupancy, ADR, RevPAR, upsells, distribution and average length of stay.

RevPAR soared by 11%: From Summer 2023 to 2024, RevPAR spiked from R1340 to R1493, hitting a high of R2197 on December 31, 2023.

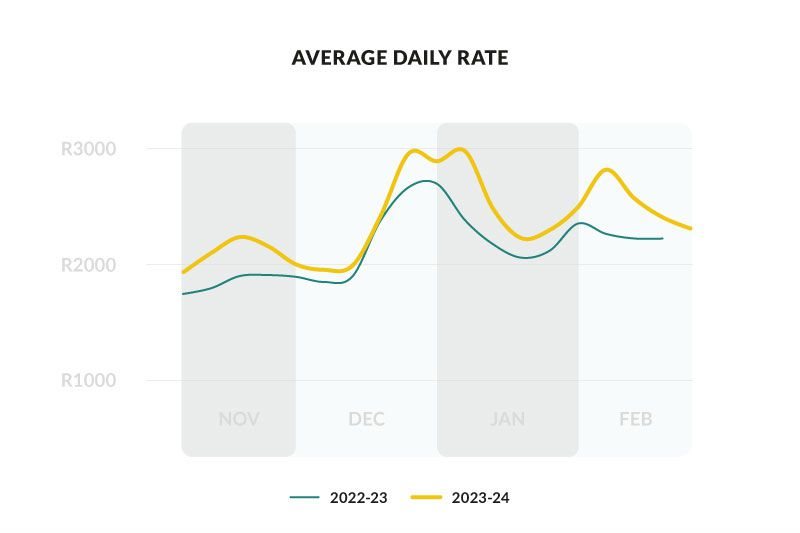

ADR rose by 10%: Capitalising on consistently high occupancy rates averaging 62% in 2022-2023 and 63% in 2023-2024, hoteliers managed to bump up the Average Daily Rate (ADR) by 10% year over year thanks to dynamic pricing strategies.

Top ancillary revenue generators: Airport shuttles lead the pack, followed by spa treatments, picnic/dining boxes, bottles of MCC/wine, and game drives. Despite inflation, guests are splurging on captivating experiences like never before.

Direct booking initiatives are on the rise: Google Hotels emerged as the second most popular booking channel after Booking.com. This signals hotels' focus on boosting direct bookings, aiming for independence from traditional OTAs. Notably, direct bookings accounted for over half of all bookings, reaching 58% in the summer of 23/24.

Niels Verspui, the market head of RoomRaccoon South Africa, highlights the resilience and adaptability of the hospitality industry in South Africa. “Our report shows that despite challenges such as fluctuating market conditions and evolving consumer preferences, people continue to travel, and hoteliers are embracing innovative strategies to enhance guest experiences and drive revenue growth.”

Niels also highlights the importance for hotels to distribute their rooms on popular OTAs in the BRICS market going forward. "There is an exciting opportunity for hoteliers to capitalise on the predicted influx of tourists from BRICS destinations. By utilising sales channels such as bed banks and local OTAs, hotels can reach out to these specific segments and increase their visibility on a global level."

To unpack the hospitality industry’s performance and key trends, download RoomRaccoon’s South African Summer Hospitality Report 2024 here.